Farage Brings Down Second Bank Boss: Coutts…

Farage Brings Down Second Bank Boss: Coutts CEO Resigns in Wake of Debanking Scandal

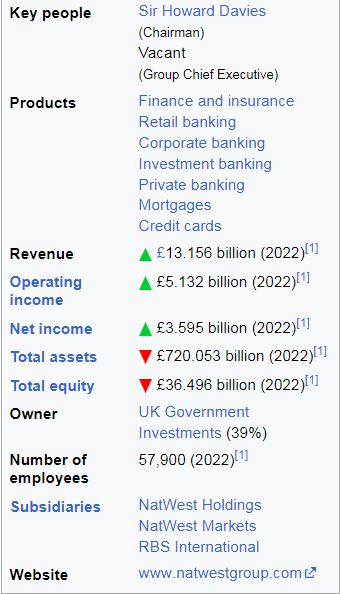

The CEO of Coutts, the exclusive bank that terminated Nigel Farage’s accounts for political reasons has said he bears “ultimate responsibility” and is consequently resigning, the second top banking figure to go over the Farage scandal in as many days.

The consequences for the politicisation of banking, manifesting itself as the debanking of Brexit leader Nigel Farage for his views, friendships, and Twitter usage, continue, with a second bank CEO resigning in two days.

Peter Flavel, the now former boss of Coutts, the prestigious bank which terminated Farage’s business and personal accounts and which is a part of the NatWest Group said that while he was “exceptionally proud” of his leadership of Coutts, nevertheless “we have fallen below the bank’s high standards of personal service” and that “As CEO of Coutts it is right that I bear ultimate responsibility for this, which is why I am stepping down.”

The move may be part of a damage limitation and clearing-out exercise by the interim CEO of NatWest Group Paul Thwaite, who was appointed yesterday after Dame Alison Rose fell on her sword over the same debanking scandal. The Guardian reports Thwaite said “I have agreed with Peter Flavel that he will step down as Coutts CEO… I believe this is the right decision for Coutts and the wider Group.”

Farage had previously called on both to resign, citing their involvement in his debanking, as well as aggressive briefing against him including the leaking of personal information to the BBC when he brought his situation to public attention in the media. He has also called for Howard Davies, the chair of the Natwest board, and the remaining members of the board to resign, given they initially backed the now-departed Dame Alison, as well as led and condoned the internal culture at the bank.

The resignation-cum-firing of Dame Alison has been reported to have been at the urging of the government. While it is not usually in the government’s gift to hire and fire the leadership of major banks, the UK is the majority shareholder of NatWest — including Coutts — after bailing it out to the tune of £45 billion during the 2008 financial crash.

This is bad news for chairman of the board, given the Prime Minister was asked today whether he supported Davies staying in post, and refused to back the top banker. It is possible further resignations may therefore follow.

The controversy around the bank’s politicising of personal finance and the consequences following that have had a major impact on its share price, NatWest Group’s stock value having collapsed yesterday morning before falling further today. The tumble has wiped hundreds of millions of pounds off the bank’s value.

Nigel Farage first revealed that he was being subjected to a campaign of debanking last month, saying his present provider was severing ties without offering an explanation why and that every other bank he had approached — ten in all — also refused to allow him to open personal and business accounts. Farage surmised this was a political move against him, and although briefings in the press against him by his own bank Coutts claimed the real reason was financial, as he was simply too poor to bank with them, it was later comprehensively proven the real reason was indeed political.

Farage was able to use the Subject Access Request legal mechanism to force the bank to surrender the documents it held on Farage, which showed Farage had been declared a persona non grata for Brexit, his friendship with President Trump, and even his retweeting of a joke by comedian Ricky Gervais.

Some of the claims against him were quite personal, including calling him a xenophobic racist, and a “disingenuous grifter”. Farage has decried them as being shocking and vitriolic, and has received an apology.

Source: https://www.breitbart.com/europe/2023/07/27/farage-brings-down-second-bank-boss-coutts-ceo-resigns-in-wake-of-debanking-scandal/ H/T SLK5

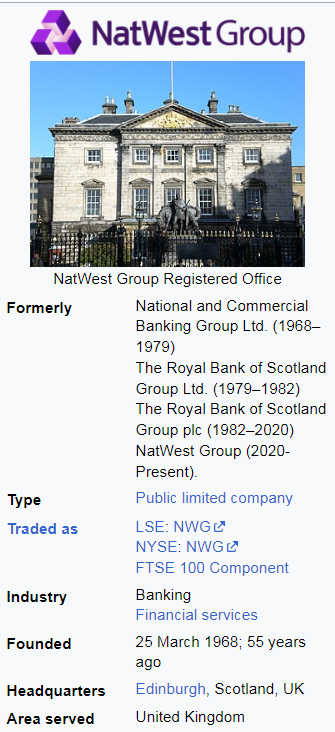

Comment: NatWest Group

This franchise serves UK corporate and commercial customers, from SMEs to UK-based multinationals, and is the largest provider of banking, finance and risk management services to UK corporate and commercial customers. It also contains Lombard entity providing asset finance to corporate and commercial customers as well as some of the clients within the Private Banking franchise. The CEO of this franchise is Paul Thwaite appointed in November 2019.

This franchise serves high-net-worth customers, the CEO of this franchise is Peter Flavel appointed in March 2016. The key private banking subsidiaries and brands of NatWest Group that are included in this franchise are Coutts, Drummonds Bank and NatWest and RBS Premier Banking

NatWest Markets is the investment banking arm of NatWest Group. It provides integrated financial solutions to major corporations and financial institutions around the world. NWMs areas of strength are debt financing, risk management, and investment and advisory services. NatWest Markets Securities is a key subsidiary, operating in the United States. The CEO of this franchise is Robert Begbie appointed in June 2020.[89]

The Royal Bank of Scotland International, trading as NatWest International, RBS International, Coutts Crown Dependencies and Isle of Man Bank, is the offshore banking arm of NatWest Group. It provides a range of services to personal, business, commercial, corporate and financial intermediary customers from its base in the Channel Islands.

Comment – please note when the Coutts Bank was founded – 1692