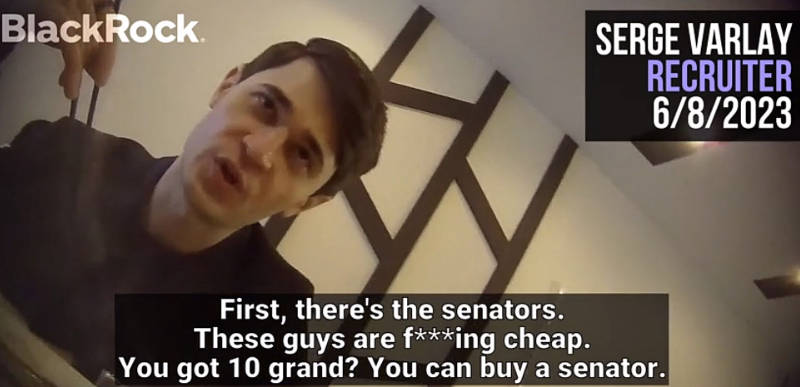

BREAKING: James O’Keefe gets BlackRock recruiter…

BREAKING: James O’Keefe gets BlackRock recruiter to spill the beans on how they “run the…

Monopoly – Documentary on How the World Works

Monopoly - a Fascinating Documentary on How the World Works https://www.youtube.com/watch?v=hSB9iNL8Vr8

BlackRock and Vanguard, own both Big Pharma and the media

Two of the largest asset management companies, BlackRock and Vanguard, own both Big Pharma and…