JoeBamanomics – An Honest Outlook

JoeBamanomics – An Honest Outlook of Inflation and What is Coming

Several people have written to CTH for an economic review of our current status. Below this post are two primary precursor articles [Primary One and Primary Two] which outline the economic dynamic in play and how we can look forward with accuracy to what is likely to happen. Despite the deflective talking points by the professional financial pundits this massive spike in inflation is entirely predictable due to Biden economic policy and Biden monetary policy.

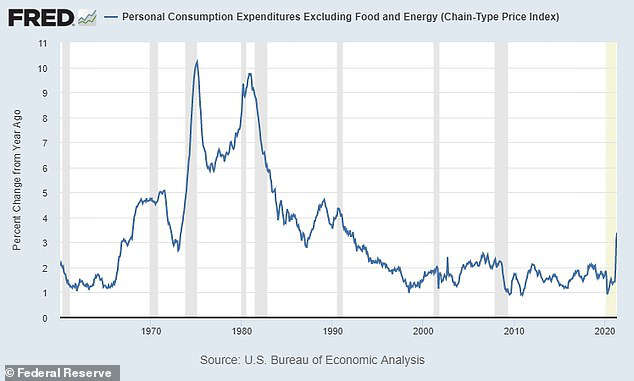

Keep in mind the FED has already said in April they would “support inflation” but that’s because while they will not say it openly they know there’s no way to stop it. The massive inflation is a direct result of the multinational agenda of the Biden administration; it’s a feature not a flaw, and it has nothing whatsoever to do with COVID. Also keep in mind the first group to admit what is to come are banks, specifically Bank of America, because the monetary policy is the cause.

There’s no way around this. Despite the pundit and financial class selling a counter-narrative, home prices will crash and unemployment will go up. I know this is directly against the current talking points, but the statistical reality is clear. CTH was the first place who said two months ago that home sales will plummet, that is starting to happen right now. There’s no way for it not to happen, the big picture tells us why.

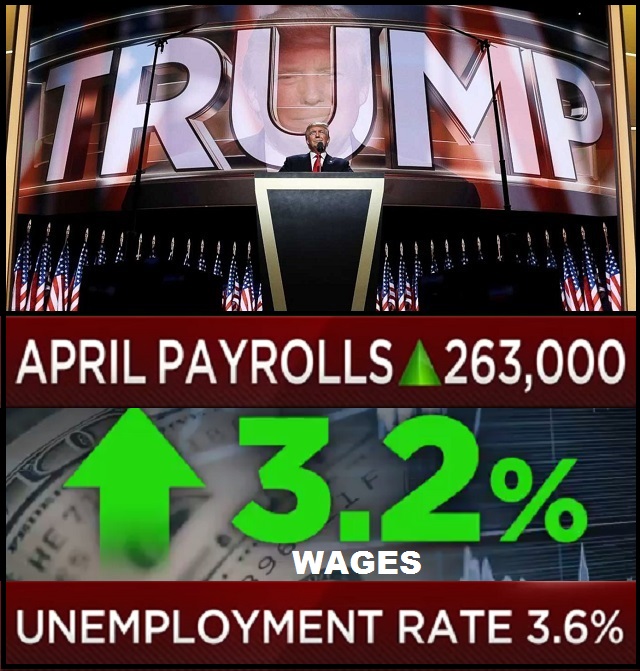

You might remember when President Trump initiated tariffs against China (steel, aluminum and more), Southeast Asia (product specific), Europe (steel, aluminum and direct products), Canada (steel, aluminum, lumber and dairy specifics), the financial pundits screamed at the top of their lungs that consumer prices were going to skyrocket. They didn’t. CTH knew they wouldn’t because essentially those trading partners responded in the exact same way the U.S. did decades ago when the import/export dynamic was reversed.

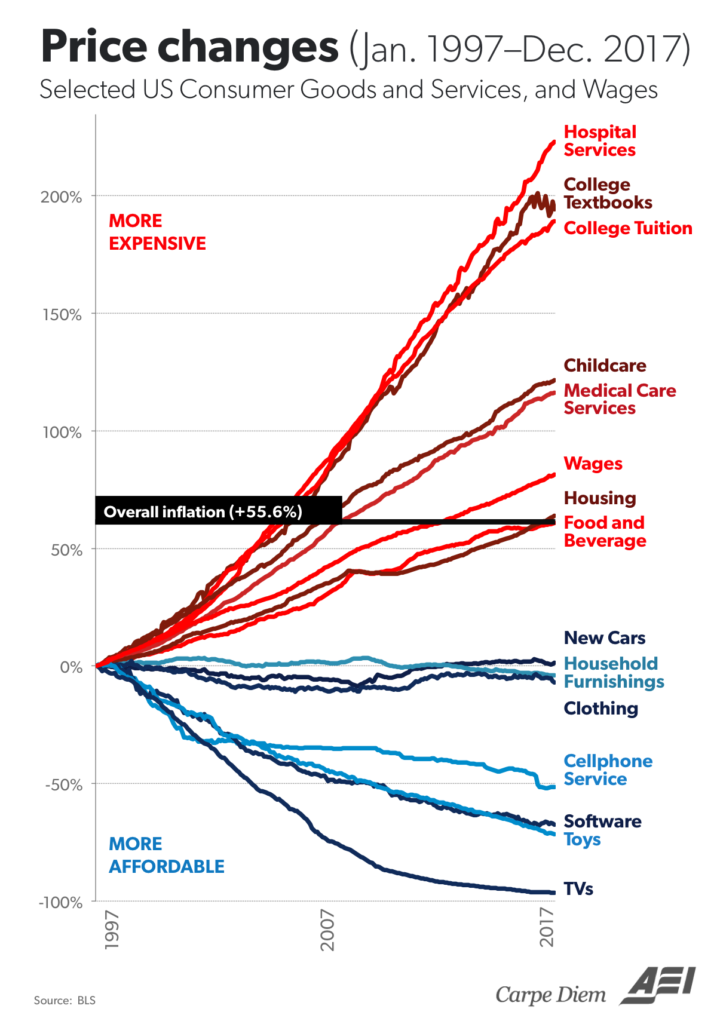

Trump’s massive, and in some instances targeted, import tariffs against China, SE Asia, Canada and the EU not only did not increase prices, the prices of the goods in the U.S. actually dropped. Trump’s policies led the largest deflation in consumer prices in decades. At the same time Trump’s domestic economic policies drove employment and wages higher than any time in the past forty years. With Trump’s policies we were in an era where job growth was strong, wages were rising and consumer prices were falling… The net result was more disposable income for the middle class, more demand for stuff, and ultimately that’s why the U.S. economy was so strong.

♦Going Deep – To retain their position China and the EU responded to U.S. tariffs by devaluing their currency as an offset to higher prices. It started with China because their economy is so dependent on exports to the U.S.

China first started subsidizing the targeted sectors hit by tariffs. However, as the Chinese economy was under pressure they stopped purchasing industrial products from the EU, that slowed the EU economy and made the impact of U.S. tariffs, later targeted in the EU direction, more impactful.

When China (total communist control over their banking system) devalued their currency to avoid Tariff price increase, it had an unusual effect. The cost of all Chinese imports dropped, not just on the tariff goods. Imported stuff from China dropped in price at the same time the U.S. dollar was strong. This meant it took less dollars to import the same amount of Chinese goods; and those goods were at a lower price. As a result we were importing deflation…. the exact opposite of what the financial pundits claimed would happen.

In response to a lessening of overall economic activity, the EU then followed the same approach as China. The EU was already facing pressure from the exit of the U.K. from the EU system; so when the EU central banks started pumping money into their economy and offsetting with subsidies they essentially devalued the euro. The outcome for U.S. importers was the same as the outcome for U.S-China importers. We began importing deflation from the EU side.

In the middle of this there was a downside for U.S. exporters. With China and the EU devaluing their currency the value of the dollar increased. This made purchases from the U.S. more expensive. U.S. companies who relied on exports (lots of agricultural industries and raw materials) took a hit from higher export prices. However, and this part is really interesting, it only made those companies more dependent on domestic sales for income. With less being exported there was more product available in the U.S for domestic purchase…. this dynamic led to another predictable outcome, even lower prices for U.S. consumers.

From 2017 through early 2020 U.S. consumer prices were dropping. We were in a rare place where deflation was happening. Combine lower prices with higher wages and you can easily see the strength within the U.S. economy. For the rest of the world this seemed unfair, and indeed they cried foul – especially Canada.

However, this was America First in action. Middle-class Americans were benefiting from a Trump reversal of 40 years of economic policies like those that created the rust belt.

Industries were investing in the U.S. and that provided leverage for Trump’s trade policies to have stronger influence. If you wanted access to this expanding market those foreign companies needed to put their investment money into the U.S. and create even more U.S. jobs. This was an expanding economic spiral where Trump was creating more and more economic pies. Every sector of the U.S. economy was benefiting more, but the blue-collar working class was gaining the most benefit of all.

♦ REVERSE THIS… and you now understand where we are with inflation. The Joebama economic policies are exactly the reverse. The monetary policy that pumps money into into the U.S. economy via COVID bailouts and federal spending drops the value of the dollar and makes the dependency state worse.

With the FED pumping money into the U.S. system the dollar value plummets. At the same time JoeBama dropped tariff enforcement to please the Wall Street multinational corporations and banks that funded his campaign. Now the value of the Chinese and EU currency increases. This means it costs more to import products and that is the primary driver of price increases in consumer goods.

Simultaneously a lower dollar means cheaper exports for the multinationals (Big AG and raw materials). China, SE Asia and even the EU purchase U.S. raw materials at a lower price. That means less raw material in the U.S. which drives up prices for U.S. consumers. It is a perfect storm… Higher costs for imported goods and higher costs for domestic goods (food). Combine this dynamic with massive increases in energy costs from ideological policy and that’s fuel on a fire of inflation.

Annualized inflation is now estimated to be around 8 percent, and it will likely keep increasing. This is terrible for wage earners in the U.S. who are now seeing no wage growth and higher prices. Real wages are decreasing by the fastest rate in decades. We are now in a downward spiral where your paycheck buys less. As a result consumer middle-class spending contracts. Eventually this means housing prices drop because people cannot afford higher mortgage payments.

Gasoline costs more (+50%), food costs more (+10% at a minimum) and as a result real wages drop; disposable income is lost. Ultimately this is the cause of Stagflation. A stagnant economy and inflation. None of this is caused by COVID-19. All of this is caused by economic policy and monetary policy sold under the guise of COVID-19.

This inflationary period will not stall out until the U.S. economy can recover from the massive amount of federal spending. If the spending continues, the dollar continues to be weak, as a result the inflationary period continues. It is a spiral that can only be stopped if the policies are reversed…. and the only way to stop these insane policies is to get rid of the Wall Street democrats and republicans who are constructing them.

Hope that makes sense, and love to all.

Be patient, be respectful, be kind and caring toward all. Don’t look for trouble. However, when the time comes to get in the fight, drop the moral approach and fight for your family with insane ferocity. Fight like you are the third monkey on the ramp to Noah’s arc…. and damned if it ain’t starting to rain.

Precursor 1 – MAGAnomics vs JoeBamanomics Understanding Inflation

In April of this year the federal reserve announced they will support the economic agenda of the Biden administration by allowing rapid inflation. The FED was trying to provide cover for JoeBama’s economic plan. The era when the FED could impact inflation is long past. However, the Joe Biden policy impact will be clear, immediate and concise. The U.S. middle-class and blue-collar worker are about to be crushed under rising prices for consumable products.

Increases in inflation hit the working class (Main St) much harder than the investment class (Wall St) and financial elites. Factually the multinationals benefit from U.S. inflation as it puts pressure on domestic companies to ship their manufacturing overseas. Wall Street likes that. This dynamic has been an issue not-discussed by the financial media for decades. First, the Reuters article (when you see “commodity prices” think about the term “consumables”):

REUTERS – The U.S. Federal Reserve has signaled it will tolerate faster inflation for a time to cement the post-pandemic recovery and boost employment, but the side effect is likely to be a faster rise in commodity prices.

[…] After its latest meeting on Wednesday, the Federal Open Market Committee confirmed it will seek to achieve the *twin objectives of maximum employment and inflation at the rate of 2% over the longer run.

[*NOTE: in the new era of global economics these two are mutually exclusive. The FED is intentionally ignoring this point.]

[…] The committee noted price rises have been running persistently below target, so it aims to achieve inflation moderately above 2% for some time to make up the shortfall and anchor expectations at around the 2% level.

[…] The plan is to run the economy hot to achieve faster job gains, especially among disadvantaged groups that are marginally attached to the labour force, before shifting back to inflation control later in the cycle.

But the resulting pressure on global supply chains while the Fed pursues employment increases is likely to generate significantly quicker price rises for raw materials and a range of manufactured items. (read more)

This perspective is fundamentally false and based on assumptions that are decades old economic arguments. The reality of what will happen is exactly the opposite on the employment front.

The JoeBama administration is attempting to hide their economic program behind the smokescreen of a COVID economic bound; but the reality of what will happen is exactly the opposite. Employment is going to drop far below pre-COVID numbers.

The problem that people do not understand, and the federal reserve will intentionally not consider, is that Macro Economic principles no longer apply in the era of global economics and multinational trade. I have outlined this dynamic for years. What did Trump see that politicians were intent on hiding?

WHAT WAS THE PROBLEM?

Traditional economic principles have revolved around the Macro and Micro with interventionist influences driven by GDP (Gross Domestic Product, or total economic output), interest rates, inflation rates and federally controlled monetary policy designed to steer the broad economic outcomes.

Additionally, in large measure, the various data points which underline macro principles are two dimensional. As the X-Axis goes thus, the Y-Axis responds accordingly… and so it goes…. and so it has historically gone.

Traditional monetary policy centered upon a belief of cause and effect: (ex.1) If inflation grows, it can be reduced by rising interest rates. Or, (ex.2) as GDP shrinks, it too can be affected by decreases in interest rates to stimulate investment/production etc. However, against the backdrop of economic Globalism -vs- economic Americanism, CTH is noting the two dimensional economic approach is no longer a relevant model. There is another economic dimension, a third dimension. An undiscovered depth or distance between the “X” and the “Y”.

I believe it is critical to understand this new dimension in order to understand Trump’s MAGAnomic principles, and the subsequent “America-First” economy he was building.

As the distance between the X and Y increases over time, the affect detaches – slowly and almost invisibly. I believe understanding this hidden distance perspective will reconcile many of the current economic contractions. I also predict this third dimension will eventually be discovered/admitted, and will be extremely consequential in the coming decade.

To understand the basic theory, allow me to introduce a visual image to assist comprehension. Think about the two economies, Wall Street (paper or false economy) and Main Street (real or traditional economy) as two parallel roads or tracks. Think of Wall Street as one train engine and Main Street as another.

Continue reading Precursor 1 here: https://theconservativetreehouse.com/blog/2021/06/26/precursor-1-maganomics-vs-joebamanomics-understanding-inflation/

Precursor 2 – MAGAnomics vs JoeBamanomics – Understanding Inflation

Reposting an earlier article by request as more people are starting to understand why CTH has focused on the financial motivations behind the political ideology for over a decade. It is critical that people understand the landscape. Underline it. Study it. Research the issues and teach everyone about it.

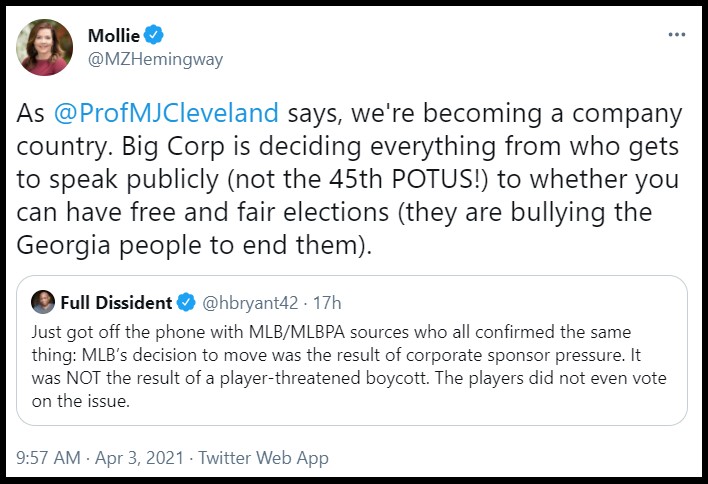

Consider if you will, the backdrop of current U.S. politics; the influence of Wall Street and the multinationals who align with globalism; the reality of K-Street lobbyists writing the physical legislation that politicians sell to Americans; and then overlay what you are witnessing as those same multinationals now attack the foundation of our constitutional republic. All of this is CORPORATISM, a continuum that people were ignoring for decades… Now, thankfully, there is a new awakening.

Positive debate on solutions and constructive criticism of approach is always appropriate for our elected officials; heck, that is the essence of our discussion. However, recently there have been many critics of President Trump; many people only just now understanding the problem and proclaiming that President Trump specifically did not do enough to block, impede, stop and counteract the globalist forces that were/are aligned against his effort to Make America Great Again.

Hindsight is 20/20, but there are people who proclaim that Donald J Trump should have been more wise in his counsel; more selective in his cabinet; more forceful in his confrontation of corporate globalists. Let me be clear….

I will never join that crew of Trump critics because I have understood his adversary for decades. CTH did not just come around to the understanding of the enemy. CTH has been outlining the scope of the enemy, the scale of the specific war and the financial and economic power of the opposition for over a decade. We understand the totality of the effort it will take to stop decades of willful blindness amid the American people. We also see with clear eyes exactly what they are doing now, even with President Trump forcefully removed from office, to destroy the threat he still represents.

Donald J Trump was/is a walking red-pill; a “touchstone”: a visible, empirical test or criterion for determining the quality or genuineness of anything political. I have been deep enough into the network of the Deep State to understand the scale and scope of this enemy. To think that President Trump alone could carry the burden of correcting four decades of severe corruption of all things political, without simultaneously considering the scale of the financial opposition, is naive in the extreme.

♦ POTUS Trump was disrupting the global order of things in order to protect and preserve the shrinking interests of the U.S. He was fighting, almost single-handed, at the threshold of the abyss. Our American interests, our MAGAnomic position, was/is essentially zero-sum. His DC and Wall-Street aligned opposition (writ large) needed to repel and retain the status-quo. They desperately wanted him removed so they could return to full economic control over the U.S, because it is the foundation of their power.

You want to criticize him for fighting harder against those interests than any single man has ever done before him? If so, do it without me.

I am thankful for the awakening Donald J Trump has provided.

I am thankful now for the opportunity to fight with people who finally understand the scale of our opposition.

Without Donald J Trump these entities would still be operating in the shadows. With Donald J Trump we can clearly see who the real enemy is.

Continue reading Precursor 2 here: https://theconservativetreehouse.com/blog/2021/06/26/precursor-2-maganomics-vs-joebamanomics-understanding-inflation/

Comment: I am in complete agreement with Sundance’s analysis and as a Canadian (yes, Canadian) – you can sign me, as one, pissed off monkey & Trump supporter. Even as far back as 2015/16 – we had strong indications as to DJT’s intended economic strategies.

We will await the outcome of the Arizona audit and then we must legally place, the rightful leader; whom I believe and many others from all over the world to be is Donald J. Trump; with or without the “no standing” SCOTUS.